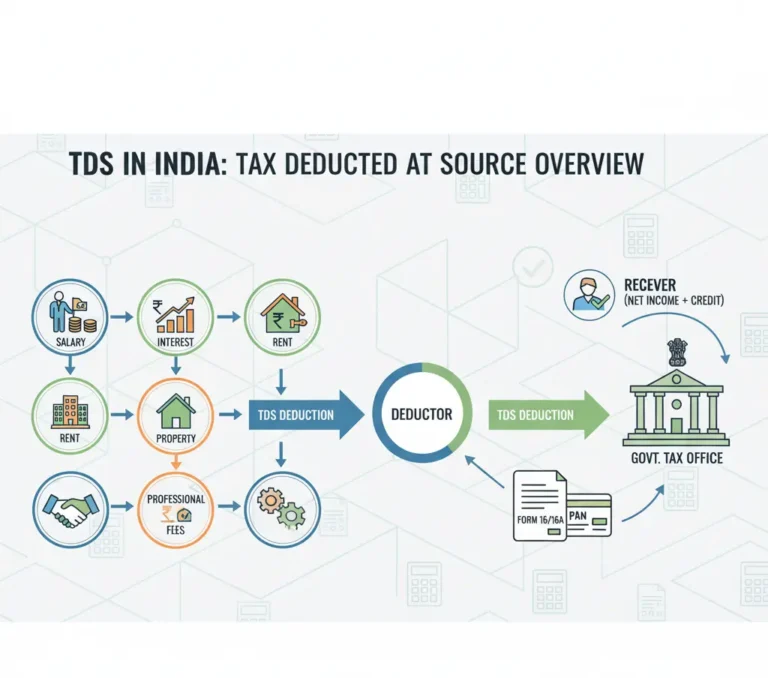

TDS means Tax Deducted at Source. The Indian government uses this method to collect income tax at the time of payment. Under this system, a person (deductor) making certain payments, such as salary, interest, rent, or professional fees, is obligated to deduct tax before making the payment to the recipient (deductee) and deposit it with the government.

- Purpose: Ensures regular collection of taxes and prevents tax evasion.

- Applicability: Applied to salaries, interest from banks, rent, contract payments, professional fees, and more.

- Rates: Vary depending on payment type and recipient category (individual, company, etc.).

- TDS Certificate: The deductee receives a TDS certificate (Form 16/16A) as proof of tax deducted.

- Adjustment: TDS deducted can be adjusted against the total tax liability of the deductee while filing income tax returns.

Types of TDS

- TDS on Salary

- Section: 192

- Applicability: Deducted by the employer from the employee’s salary.

- Rate: As per the income tax slab of the employee.

- Purpose: Advance collection of income tax from salary income.

- TDS on Interest Income (Fixed Deposit)

- Section: 194A

- Applicability: Deducted by banks/financial institutions on interest from fixed deposits.

- Rate: 10% if PAN is provided; 20% if PAN is not provided.

- Threshold: Applicable if interest exceeds ₹40,000 (₹50,000 for senior citizens).

- TDS on Interest from Bonds

- Section: 193

- Applicability: Deducted from interest earned from debentures or bonds.

- Rate: 10% (if PAN is provided; 20% without PAN).

- TDS on Insurance Commission

- Section: 194D

- Applicability: Deducted by insurance companies on commission paid to agents or intermediaries.

- Rate: 5%

- TDS for Contractors

- Section: 194C

- Applicability: Deducted from payments made to contractors or subcontractors for work or supply contracts.

- Rate: 1–2% depending on the type of recipient.

- TDS on Interest on Deposits in Savings Accounts

- Section: 194A

- Applicability: Deducted by banks on interest earned in savings accounts if it exceeds ₹10,000 in a year.

- Rate: 10% (PAN required; 20% without PAN).

- TDS on Rent

- Section: 194I / 194IB

- Applicability: Deducted from rent paid for land, building, or machinery.

- Rate: 10% for individuals/HUF (if rent > ₹50,000/month, Section 194IB) & 2% for others (companies, firms, Section 194I)

- TDS on Shares and Mutual Funds (Dividends)

- Section: 194 / 194K

- Applicability: Deducted by companies or mutual funds when paying dividends to shareholders or unit holders.

- Rate: 10% (on dividend exceeding ₹5,000 per year).

- TDS on Property (Sale of Immovable Property)

- Section: 194IA

- Applicability: Deducted by the buyer when purchasing immovable property above ₹50 lakh.

- Rate: 1% of the sale consideration.

- TDS on Brokerage

- Section: 194H

- Applicability: Deducted from brokerage or commission payments paid to agents or brokers.

- Rate: 5%

- TDS on Fees for Professional and Technical Services

- Section: 194J

- Applicability: Deducted from payments made to professionals, consultants, or technical experts.

- Rate: 10%

Who Needs to Pay TDS

TDS (Tax Deducted at Source) is paid by the payer, also known as the deductor. Employers, banks, businesses, or people who pay for things like commissions, professional fees, interest, rent, salaries, or real estate transactions fall under this category. Before making the payment and depositing it with the government, the deductor is in charge of taking out the relevant tax.

Understanding TDS is especially important for freelancers and professionals because clients may withhold taxes from payments given to you. If you are a freelancer and want to know more about TDS, read our blog about TDS Rules for Freelancers and Professionals.

TDS Certificate

A TDS Certificate is an official document issued by the deductor (the person or entity that deducts tax at source) to the deductee (the person receiving the payment). It acts as evidence that taxes have been collected and turned in to the government.

- Purpose: Confirms that the TDS has been deducted and paid to the Income Tax Department.

- Types:

- Form 16: Issued for TDS on salary.

- Form 16A: Issued for TDS on payments other than salary (e.g., professional fees, rent, interest).

- Details Included:

- Name and PAN of the deductor and the deductee

- Amount paid and TDS deducted

- TDS deposit challan number

- Period of deduction

- Use: Can be used by the deductee to claim TDS credit while filing income tax returns.

- Issuance: Usually issued quarterly for non-salary payments and annually for salary.

TDS Form

A TDS form is a document used to file and report tax deductions at source to the Income Tax Department. Different TDS forms are used based on the type of payment and whether it is a salary or non-salary payment.

Common TDS Forms

- Form 16

- Issued by the employer to employees.

- Certificate for TDS on salary.

- Contains details like salary paid, TDS deducted, tax deposited, and PAN details.

- Form 16A

- Issued for TDS on non-salary payments (professional fees, rent, interest, commission).

- Issued quarterly by the deductor.

- Form 26AS

- Consolidated tax credit statement maintained by the Income Tax Department.

- Shows all TDS deducted and deposited against your PAN.

- Can be used while filing income tax returns.

- Form 24Q

- Quarterly TDS return for salaries submitted by employers to the Income Tax Department.

- Form 26Q

- Quarterly TDS return for non-salary payments submitted by deductors.

Purpose of TDS Forms

- To record and report tax deducted at source.

- To provide proof of TDS to the deductee.

- To enable the deductee to claim TDS credit while filing income tax returns.

How to Pay TDS

Paying TDS is the duty of the deductor (the person or entity making the payment). It entails deducting taxes at the source, submitting them to the government, and filing returns.

Step 1: Deduct TDS

- Determine if the payment is subject to TDS under the Income Tax Act.

- Deduct the appropriate rate of tax from the payment before giving it to the payee (employee, contractor, or professional).

- Ensure the PAN of the deductee is provided to apply the correct TDS rate.

Step 2: Deposit TDS

- Visit the TIN NSDL portal or use authorized bank branches to deposit TDS.

- Use Challan ITNS 281 for TDS payment.

- Fill in details like:

- Deductor and deductee PAN

- Type of payment

- TDS amount deducted

- Date of payment

Step 3: File TDS Return

After depositing TDS, file a TDS return online through the NSDL portal.

Common forms:

- Form 24Q – TDS on salary

- Form 26Q – TDS on non-salary payments

The return contains details of TDS deducted, TDS deposited, and deductee information.

Step 4: Issue TDS Certificate

- Issue Form 16 for salary or Form 16A for non-salary payments to the deductee.

- This serves as proof of the tax deducted and deposited.

Advantages of TDS

- Ensures Regular Tax Collection: TDS enables the government to collect taxes in advance, easing the burden on taxpayers at the end of the fiscal year.

- Reduces Tax Evasion: By deducting tax at the source of income, TDS minimizes the chances of tax evasion.

- Convenient for Taxpayers: Tax is deducted before the recipient receives the payment, making it easier for individuals to comply without worrying about large lump-sum payments later.

- Facilitates Easy Credit Adjustment: The deductee can claim TDS as tax credit while filing income tax returns, ensuring proper accounting of taxes already paid.

- Promotes Transparency: TDS involves proper documentation and certificates (Form 16/Form 16A), providing clear records for both the deductor and the deductee.

- Applicable Across Various Income Sources: TDS applies to salary, interest, rent, professional fees, dividends, property transactions, and more, ensuring comprehensive coverage.

- Supports Government Revenue Management: Continuous collection of TDS helps the government manage cash flow and fund public services effectively.

How to Check TDS Status

Checking your TDS status ensures that the tax deducted by the deductor has been remitted to the government and credited correctly to your PAN.

- Step 1: Visit the TRACES Website

- Go to the official TRACES portal

- TRACES stands for TDS Reconciliation Analysis and Correction Enabling System.

- Step 2: Register/Login

- If you are a deductee, register with your PAN.

- If you are a deductor, log in using your deductor TAN and password.

- Step 3: Navigate to the TDS Status Section

- For deductees: Go to “View Tax Credit (Form 26AS)”.

- You can also download Form 26AS, which is a consolidated statement of all TDS deducted and deposited against your PAN.

- Step 4: Check TDS Details

Form 26AS shows:

- TDS amount deducted

- Date of deduction

- Deductor details

- Challan details of TDS deposited

- Step 5: Verify and Reconcile

- Match the TDS shown in Form 26AS with your salary slips, bank statements, or invoices.

- If there’s a mismatch, contact the deductor or file a correction request through TRACES.

Final Thoughts

Understanding TDS (Tax Deducted at Source) is essential for both people and businesses to comply with income tax regulations and avoid fines. From salary and professional fees to rent, interest, and property transactions, TDS is a procedure that streamlines tax collection and minimizes the burden at the end of the financial year.

Navigating TDS regulations, appropriate rates, and filing procedures, however, can occasionally be challenging. Here’s where professional advice can really help. If you’re looking for expert assistance, it’s wise to hire a Financial Advisor in Kerala who can help with TDS planning, filing, and overall tax management, guaranteeing that you stay compliant while enhancing your tax position.