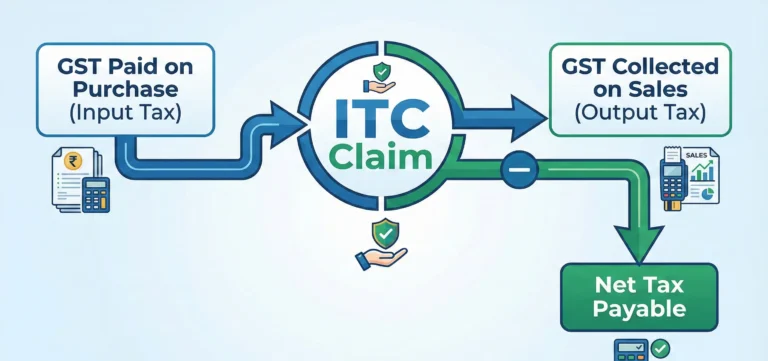

Input Tax Credit (ITC) is a GST system that allows firms to deduct the tax they have already paid on purchases from their overall output tax burden. In simpler terms, if your business buys goods or services and pays GST on them, you can claim that tax paid as a credit and offset it against the GST you need to pay on sales. This ensures that tax is only levied on the value contributed at each stage of the supply chain, preventing tax cascading.

For accurate guidance on claiming ITC and maximizing tax benefits, Team Taxperts, a group of experienced tax professionals, can help. They are your go-to financial advisor in Kerala, providing knowledgeable guidance on ITC claims, GST, and general business financial planning.

How Does ITC Work

Input Tax Credit (ITC) enables businesses to lower the tax they pay on sales by using the GST they’ve already paid on purchases. The procedure is as follows, step-by-step:

- Purchase of Goods/Services: When a business buys goods or services, it pays GST to the supplier.

- Recording GST Paid: The GST paid on these purchases is recorded as input tax.

- Claiming ITC: When filing GST returns, the business can claim the GST paid on inputs as a credit.

- Offsetting Against Output Tax: The claimed ITC can be used to reduce the GST liability on sales (output tax). For example, if a business owes ₹10,000 in GST on sales but has ₹4,000 as ITC, it only needs to pay ₹6,000.

- Payment of Balance Tax: The remaining GST after applying ITC is paid to the government.

Key Points:

- ITC can be claimed only if the goods/services are used for business purposes.

- Proper invoices and GST-compliant documentation are necessary to claim ITC.

Why is Input Tax Credit Important

- Reduces Tax Burden: ITC allows businesses to offset the GST paid on purchases against the GST collected on sales, reducing the overall tax liability.

- Prevents Tax Cascading: Without ITC, tax would be charged on tax at every stage of production or supply. ITC ensures tax is levied only on the value added, preventing the “tax on tax” effect.

- Improves Cash Flow: By claiming ITC, businesses can lower the amount of GST they need to pay, helping maintain better cash flow for operations.

- Encourages Compliance: Businesses are motivated to maintain proper invoices and documentation to claim ITC, promoting transparency and accountability.

- Supports Business Growth: ITC helps reduce costs, making products and services more competitively priced, which can positively impact profitability and growth.

Who All Are Eligible for Input Tax Credit

Under GST, the following categories of taxpayers can claim ITC:

- Registered Businesses: Only GST-registered businesses can claim ITC. Unregistered entities are not eligible.

- Purchasers of Goods/Services for Business: ITC can be claimed on goods or services used for business purposes, such as raw materials, office supplies, or business-related services.

- Recipients of Taxable Supplies: Businesses receiving taxable goods or services (including imports) can claim ITC, provided GST has been paid by the supplier.

- Proper Documentation: Businesses must have a valid tax invoice, debit note, or other prescribed documents to claim ITC.

- Timely Filing: ITC can be claimed only if the GST returns are filed within the specified time under the GST laws.

ITC is not available for personal use, motor vehicles (with a few exceptions), goods/services used for exempt supplies, or items like food and entertainment for personal consumption.

How to Claim ITC

Claiming ITC under GST involves a few key steps: =

- Ensure GST Registration: Only businesses registered under GST can claim ITC.

- Maintain Proper Documentation: Keep valid tax invoices, debit notes, or bills of supply for all purchases on which GST is paid.

- Check Eligibility: Ensure that the goods or services purchased are used for business purposes and are not excluded under GST rules.

- Match Supplier’s Details: Verify that the GST paid on purchases matches the details uploaded by the supplier in their GST returns.

- File GST Returns: Claim ITC while filing your monthly/quarterly GST returns (GSTR-3B). Enter the eligible credit in the designated ITC sections.

- Adjust Against Output Tax: Use the claimed ITC to offset your GST liability on sales. Pay only the balance tax, if any.

- Maintain Records: Keep all documents and records for at least 6 years, as they may be required during audits or assessments.

How ITC Works in GST

Input Tax Credit (ITC) under GST allows businesses to reduce their tax liability on sales by claiming credit for the GST already paid on purchases. Here’s how it works:

- Purchase of Goods/Services: A business buys goods or services and pays GST to the supplier.

- Recording GST Paid: The GST paid on these purchases is recorded as input tax.

- Claiming ITC: While filing GST returns, the business claims ITC on eligible purchases.

- Offsetting Against Output Tax: The ITC is used to reduce the GST payable on sales.

- Payment of Balance Tax: The remaining tax, after applying ITC, is paid to the government.

Managing ITC and GST compliance can be difficult, especially with the regular changes in laws. Team Taxperts offers professional assistance for precise ITC computations and claims. Additionally, they provide accounting and bookkeeping services in India, assisting businesses in maintaining accurate, compliant, and structured financial records while maximising tax benefits.

Benefits of Input Tax Credit

- Reduces Total Tax Liability: ITC allows businesses to use the GST paid on purchases to reduce the GST payable on sales, lowering their overall tax burden.

- Prevents Double Taxation: By eliminating the cascading effect (tax on tax), ITC ensures that tax is charged only on the value added at each stage.

- Improves Cash Flow: Since businesses pay only the net GST amount after applying ITC, it helps maintain better liquidity and smoother operations.

- Encourages Transparency: To claim ITC, businesses must maintain proper documentation and ensure supplier compliance, which promotes clean records and financial discipline.

- Enhances Profit Margins: Lower tax costs help reduce product or service pricing, improving profitability and market competitiveness.

- Supports Business Growth: With reduced financial strain and better cash management, businesses can reinvest in operations, expansion, and innovation.

Cases Where Input Tax Credit (ITC) is Not Available

- Personal Use: ITC is not allowed on goods or services used for personal consumption rather than business purposes.

- Exempt Supplies: If the goods or services are used to supply exempt or non-taxable items, ITC cannot be claimed.

- Motor Vehicles (With Exceptions): ITC on motor vehicles used for personal transport (like cars and bikes) is not allowed, except when used for:

- Transportation of passengers

- Goods transport

- Training or supplying vehicles on rent

- Food, Beverages & Entertainment: ITC is restricted on expenses such as food, beverages, outdoor catering, beauty treatment, health services, club memberships, and entertainment—unless they are used for making outward taxable supplies of the same category.

- Works Contract Services: ITC on works contracts used for the construction of immovable property (other than plant and machinery) is not available.

- Construction of Immovable Property: Expenses related to the construction, renovation, or repairs of buildings used for business are not eligible for ITC, unless they are used for providing the same service.

- Goods Lost, Stolen, or Destroyed: ITC cannot be claimed on goods lost, stolen, destroyed, written off, or given as free samples.

- Late Filing of Returns: If GST returns are not filed within the prescribed time limits, ITC claims may be denied.

- Supplier Non-Compliance: If the supplier has not uploaded invoices or paid GST to the government, the recipient cannot claim ITC.

Final Thoughts

One of the most effective characteristics of the GST system is the Input Tax Credit (ITC), which helps businesses minimize their tax burden, maintain healthy cash flow, and ensure financial transparency. By learning how the ITC works, who is qualified, and the conditions under which credit cannot be claimed, businesses can maximize their tax planning and prevent costly compliance mistakes.

For businesses that want to make the most of ITC while staying fully compliant, Team Taxperts provides qualified assistance you can rely on. Taxperts, a recognized Financial Advisor in Kerala, assists with GST filing, ITC optimization, and general financial management to ensure your accounts are correct, up to date, and audit-ready. Navigating ITC becomes easy, effective, and stress-free with the correct assistance.

FAQs

Can Input Tax Credit Be Refunded?

Yes, ITC can be refunded, but only in specific cases such as exports, supplies to SEZs, or when there’s an inverted duty structure (higher tax on inputs than outputs). Refunds are not allowed for exempt supplies or items where ITC is restricted. In simple terms, ITC refunds are possible, but only when the GST law permits them under eligible conditions.

Can Input Tax Credit Be Carried Forward?

Yes, Input Tax Credit (ITC) can be moved forward to the next tax period if it has not been utilized entirely in the current month. The unused ITC can be utilized to offset future GST liabilities if it is legitimate, eligible, and accompanied by suitable documentation.

Where to Check Input Tax Credit in GST Portal?

You can check your Input Tax Credit (ITC) on the GST portal by logging in and navigating to Services → Returns → ITC Forms or by viewing GSTR-2B and GSTR-3B. These sections show all eligible, ineligible, and available ITC details for the relevant tax period.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.