Starting a new business in Kerala? One of the first and most critical procedures is to complete your GST registration properly. Whether you’re a new entrepreneur, a small business owner, or expanding an existing venture, GST registration is required whenever you reach the prescribed revenue threshold. However, before you start the online process, having the necessary paperwork ready can save you time, prevent rejections, and ensure an effortless approval.

In this blog, we’ll cover the primary documents required for new GST registration in Kerala, explain their importance, and guide how to upload them correctly. Let’s get you GST-ready the effortless way.

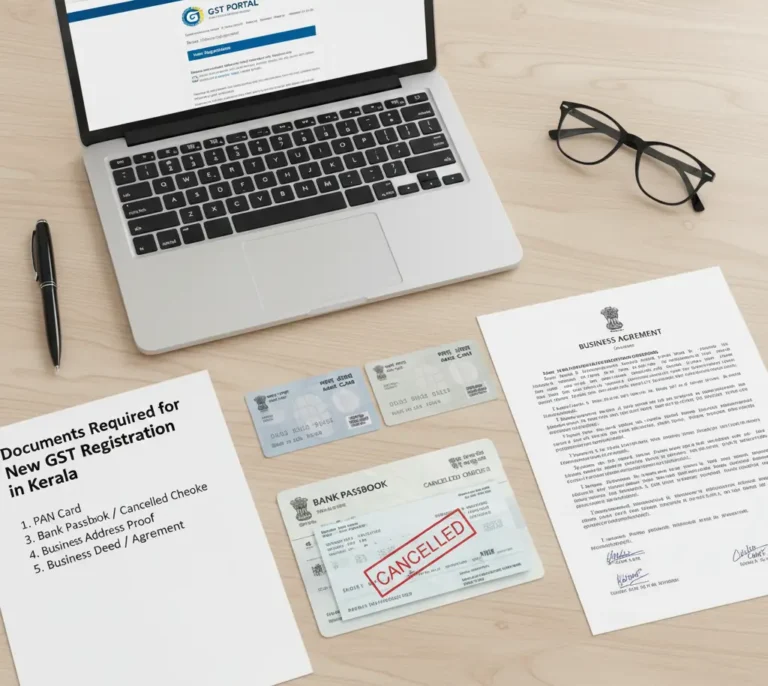

These are the Documents Required for New GST Registration in Kerala

To ensure a seamless and effective GST registration procedure in Kerala, businesses must provide appropriate documents verifying their name, business location, and financial information. Every document is essential to proving the applicant’s legitimacy and avoiding inconsistencies during verification. Here’s a detailed explanation of what you require and why:

- PAN: The Permanent Account Number (PAN) is a mandatory identifying document for GST registration. For individuals, the personal PAN is required, while for businesses such as partnerships, companies, or LLPs, the PAN of the organization must be submitted. It serves as the key tax identifier and connects all financial transactions into a single system.

- Identity and Address Proof with Photograph: Candidates must provide proof of identification and address, such as a driver’s license, passport, voter ID, or Aadhaar. These documents authenticate the applicant’s legitimacy and ensure that the GST registration is granted to a verified individual. A clean, current photograph is also necessary for supplementary identity verification.

- Proof of Business Address: To prove the physical address of your company, you must supply paperwork such as a rental agreement, utility bill, property tax receipt, or ownership document. This aids GST authorities in making sure that business operations are carried out at a legitimate and traceable address.

- Bank Account Details: Bank account information is required for integrating your business transactions into the GST system. A cancelled cheque, a copy of your passbook, or a bank statement can be submitted. These records aid in verifying the financial account linked to your company for compliance, payments, and refunds.

- Authorization Letter / Board Resolution: If your GST application is being filed by an authorized signatory rather than the business owner, you must provide a permission letter or board resolution. This document certifies that the person managing the GST processes is authorized to act on the company’s or entity’s behalf.

Additional Documents Based on Business Structure

Apart from the basic documents required for GST registration, Kerala businesses must also provide documentation unique to their business structure. These extra records assist authorities in confirming the entity’s ownership, legal establishment, and operational authorization.

Sole Proprietorship:

Sole proprietors must produce documents establishing their identity and ownership of the business. Typical supplementary documents consist of:

- Owner’s Aadhaar Card

- Owner’s PAN (mandatory as business PAN is not applicable)

- Trade license / Shop & Establishment Certificate

These documents guarantee the legal recognition of the business and its owner as the same.

Partnership Firm

Documents attesting to the partnership’s existence and partners’ rights must be provided by partnership firms. Among them are:

- Partnership Deed

- PAN of the Partnership Firm

- Authorization letter from the partners

- Partner’s ID and address proof

These documents affirm the legal structure and specify which partners are responsible for GST compliance.

Limited Liability Partnership (LLP)

Since LLPs are incorporated entities, their establishment must be validated by extralegal documents. These include:

- LLP Agreement

- Certificate of Incorporation issued by the Ministry of Corporate Affairs (MCA)

- Resolution appointing an authorized signatory

- Designated partners’ ID and address proof

This guarantees that the firm complies with MCA standards and GST requirements.

Private Limited Company

Private limited corporations are required to submit thorough documentation proving their corporate identity and authorized representation. These include:

- Certificate of Incorporation issued by MCA

- Memorandum and Articles of Association (MOA & AOA)

- Board Resolution authorizing a director for GST activities

- Director’s ID and address proofs (DIN, PAN, Aadhaar, etc.)

These records attest to the organization’s legal standing, governing body, and authorized staff.

Final Thoughts

The first step towards a fast and hassle-free GST registration in Kerala is to ensure that you have the necessary paperwork. From fundamental identity proofs to business structure-specific documentation, each criterion is critical to authenticating your firm and avoiding approval delays. Whether you’re a new entrepreneur or expanding your business, maintaining compliance from the start helps you develop a solid financial foundation.

If you require expert guidance throughout the process, Taxperts can help you with professional support, precise documentation, and end-to-end compliance. For a smooth experience, always hire the best financial advisor in India—someone who genuinely understands the state’s regulatory system and ensures everything is done correctly.

Are you prepared to have a stress-free GST journey? Let Taxperts take care of the details so you can concentrate on expanding your company.